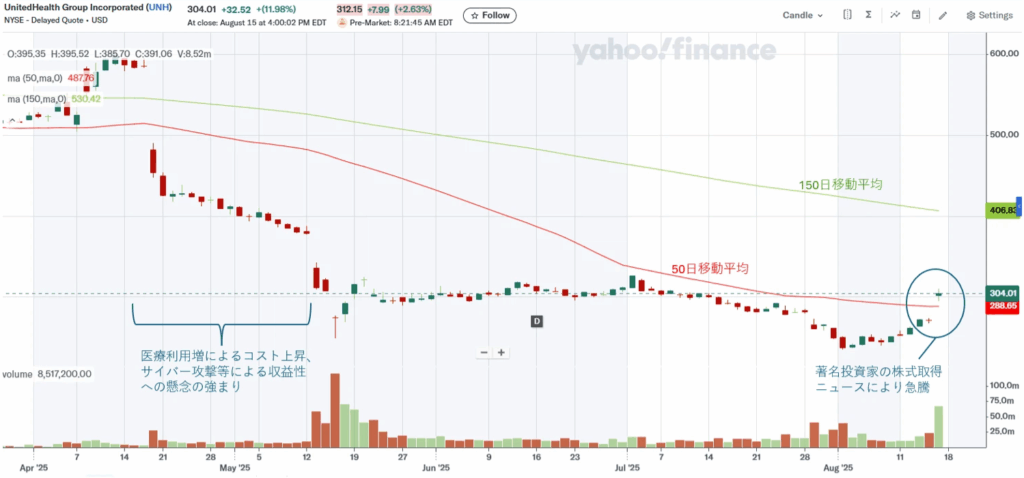

In this article, I analyze UnitedHealth Group—one of the most closely watched names in the U.S. equity market and the country’s largest healthcare company. Over the past year, the company’s results and share price have been under pressure from headwinds such as cyberattacks and rising healthcare costs. Still, investor interest has surged after disclosures that prominent investors like Warren Buffett and Michael Burry have been buying UnitedHealth shares. Here, we take a deep dive into UnitedHealth’s current position amid these challenges and evaluate its investment appeal going forward.

What is United Health?

UnitedHealth Group is one of the largest healthcare companies in the U.S. Its strength lies in its comprehensive system that covers the entire spectrum of healthcare, from providing health insurance to offering medical services (clinic operations, prescription management, etc.). Recently, the company has also been actively investing in IT fields such as data analytics and telehealth.

主な事業部門は:

Main Business Segments:

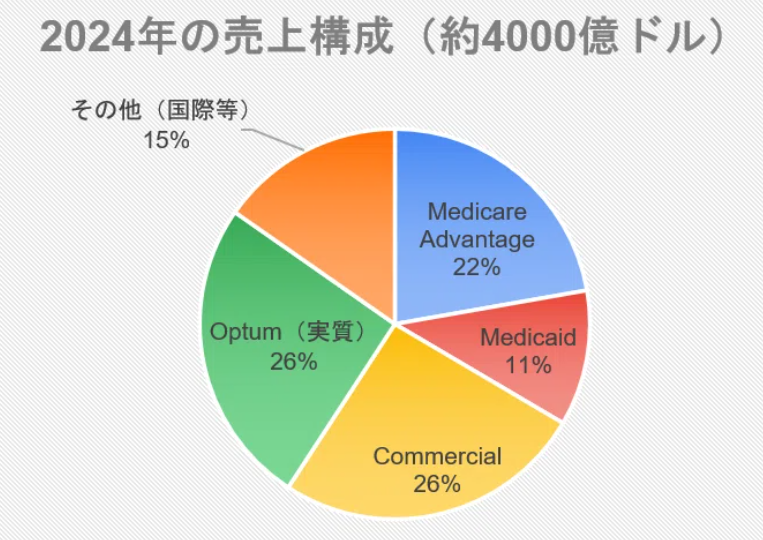

- UnitedHealthcare: Provides public insurance for seniors (Medicare Advantage), public insurance for low-income individuals (Medicaid), and insurance for employers/individuals (Commercial).

- Optum: Provides healthcare services (clinics, home health care, etc.), medical data analytics, and pharmacy benefit management. It conducts business not only with its own insurance members but also with external medical institutions and pharmacies.

This diversified structure is key to generating stable revenue and growth.

Business Model of the U.S.’s Largest Healthcare Company

UnitedHealth primarily operates within the U.S. It uses its insurance services (UnitedHealthcare) as a stable foundation while driving growth through its medical services and prescription management services (Optum).

UnitedHealthcare’s Medicare Advantage and individual/employer insurance (Commercial) have seen steady membership growth, with revenue growing at an annual rate of approximately 10%. The total number of insurance members is about 52 million, giving it a market share of approximately 14.2%, making it the largest in the U.S.

Optum achieved approximately 15% annual revenue growth in 2024, acquiring around 750 new customers for its prescription management service.

Performance Highlights and Growth Strategy

UnitedHealthの過去の業績と今後の成長戦略について見ていきます。

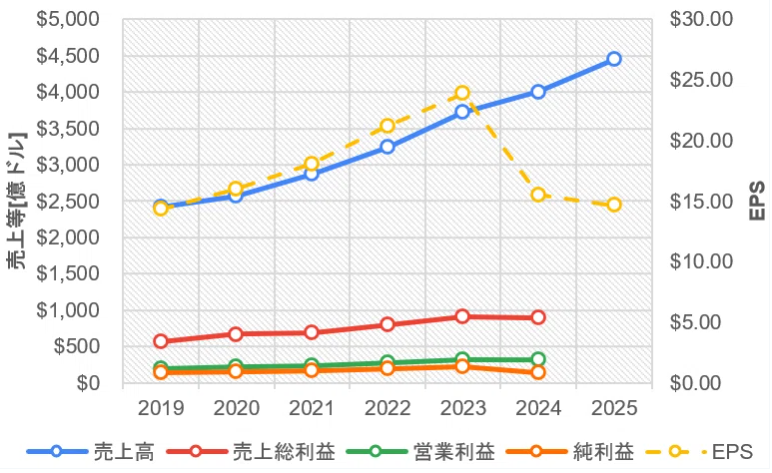

Stable Growth until 2023, followed by a sharp slowdown in 2024

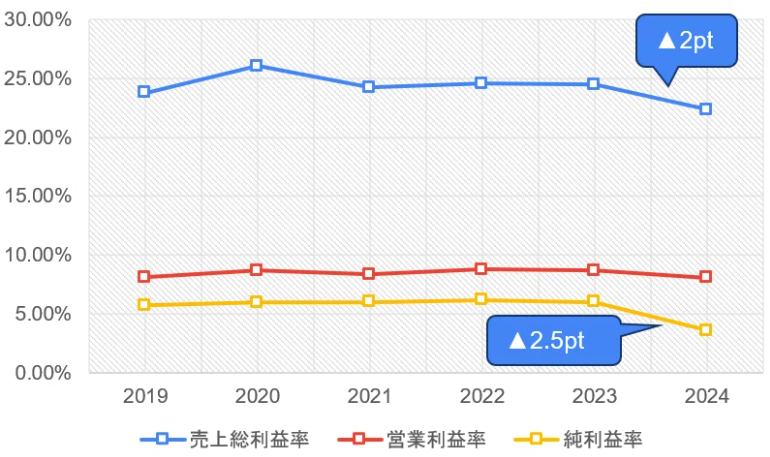

From 2019 to 2023, revenue grew steadily at an annual pace of about 10%, driven by new member acquisition at United Healthcare and growth in Optum. Gross profit margin remained stable at about 25%, operating margin at about 8%, and net profit margin at about 6%. EPS also grew at a high rate of approximately 15% annually in line with revenue expansion.

Despite stable growth until 2023, the pace sharply decelerated starting in 2024.

In 2024, while revenue growth remained consistent, gross profit decreased by -2% year-over-year, and net profit decreased by -2.5% year-over-year, indicating profit pressure. Furthermore, EPS dropped significantly from approximately $24 to about $15, a -35% decrease.

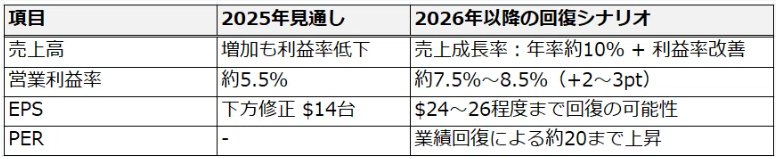

The 2025 guidance projects 11% year-over-year revenue growth but an unsatisfactory negative EPS growth of -5.5% (to $14.65).

What exactly happened in 2024 and beyond?

The decline in profit and EPS starting in 2024 was caused by a combination of factors, primarily the following:

Decline in Profit from Medicare Advantage

Profits fell due to changes in the U.S. government’s payment structure for Medicare Advantage, the public insurance program for seniors. The payment system became stricter, shifting to a structure where the government provides less compensation (insurance premiums) than before for members utilizing high-cost medical services, particularly seniors. Compounded by rising medical expenses due to inflation, UnitedHealth’s burden (payment of medical costs to members) increased, putting pressure on profits. This change is expected to lead to a cumulative revenue reduction of approximately $11 billion over three years.

Cyberattack

A ransomware attack in February 2024 caused billing processes at Change Healthcare, a UnitedHealth subsidiary, to be halted for several months. This led to payment delays and billing errors for healthcare providers, resulting in approximately $3.1 billion in direct costs. This was a major contributor to the significant drop in EPS.

Key Points for Performance Improvement

The loss from the cyberattack is temporary and is not expected to affect future performance. However, the impact of the Medicare payment structure changes and rising medical costs is expected to persist for several years, as insurance premiums and contract terms cannot be changed immediately. The key to future performance improvement lies in how successfully the company addresses these challenges and improves its profit margin.

Future Strategies for Performance Recovery

According to the Q2 2025 earnings announcement, UnitedHealth will implement premium revisions to improve the profitability of its insurance services, especially Medicare Advantage, to restore performance. It will also utilize data analysis to reduce excessive and unnecessary medical services.

The company’s goal is to achieve approximately $1 billion in cost reduction by 2026. Furthermore, it aims to improve the operating margin of the Optum segment, the growth driver, from 2.5% in Q2 2025 to a long-term goal of 6-8%.

Investment Appeal from Valuation and Financial Health

The valuation is at an inexpensive level due to the sharp drop in stock price following the performance deterioration. Compared to the past few years, the stock is oversold. Despite the headwinds of rising medical costs, the company maintains abundant cash flow and is proactive in dividends and share buybacks. If the performance outlook improves, it is a very attractive investment target.

Valuation (as of August 2025)

- PER (P/E Ratio): Approx. 13x (Trailing 12 months average) (Undervalued; historically traded above 20x for several years.)

- PBR (P/B Ratio): 2.85x

- EV/EBITDA: Approx. 11.7x (Similar to the industry average)

Shareholder Returns

- Dividend Yield: Approx. 3.25%

- Payout Ratio: 36.5%

- Share Buybacks: Executed a buyback of approximately $5 billion in Q1 2025.

Financial Health (2024)

ROE is at a high level, indicating efficient use of capital to generate earnings. The strong cash-generating capability remains robust despite the headwinds of rising medical costs.

- ROE: 15.9%

- Debt Ratio: Approx. 83%

- Note: High debt ratio is common for insurance companies as reserves for medical payments are recorded as liabilities.

- Operating Cash Flow: $24.2 billion

- Free Cash Flow: $11.5 billion

Investment Scenarios

Let’s examine the investment scenarios based on the macro market environment and UnitedHealth’s future performance recovery strategies.

Macro Market Environment

- Medical Cost Inflation: Continues to rise. Medical cost inflation for employer-sponsored plans is projected to be approximately 5.8% in 2025, exceeding the average growth rate of the past decade (approx. 3%).

- Government Regulation: Legislation is being debated to strengthen transparency requirements for prescription pricing (e.g., banning “spread pricing”). State-level legislation for compensation and pricing transparency is also progressing.

- Interest Rate Environment: Entering a phase of interest rate cuts, which is neutral to a slight tailwind for the insurance industry.

Base Case

Operating margins recover from 2026 onward through price revisions and operational efficiencies. However, the recovery is modest due to persistent medical cost inflation and government demands for stricter prescription pricing.

Stock Price Range (EPS × PER): $348.5 to $425.

Bull Case

Operating margins recover significantly from 2026 onward. The company successfully absorbs the impact of rising medical costs and government regulatory demands.

Stock Price Range (EPS × PER): $500 to $600.

Bear Case

Despite corrective actions, there is no profit margin improvement due to persistent medical cost inflation, stricter government demands for prescription pricing, and potential government budget cuts to Medicaid.

Stock Price Range (EPS × PER): $182 to $195.

My Investment Decision

Investment Decision: Buy for the medium to long term.

Reason:

Based on these factors, I believe there is a high probability that performance will gradually recover from 2026 onward, aligning with the Neutral Base Case.

The current stock price hovers around $300, and the PER is approximately 13x, representing an inexpensive valuation. Even under the Neutral Base Case, there is about 30% upside potential. In the Bull Case, there is an attractive 83% upside.

Membership and revenue are expected to grow steadily in the future due to the aging population. The key to performance recovery will be the company’s ability to appropriately manage the surge in medical costs.

Given its position as the largest player and its competitive advantage from vertical integration (from insurance to healthcare service provision), the company can easily pass on costs through premium adjustments. Cost reduction utilizing the data analytics capabilities of the Optum segment is also considered realistically achievable.

Conclusion

This article provided an analysis of UnitedHealth, the largest health insurer in the U.S. Although performance is currently deteriorating due to reduced government revenue and rising medical costs, we predict a gradual recovery through price increases on insurance premiums and the reduction of waste using data analytics.